Blog

Stay Current.

Maximizing Value Through Global Expansion into Europe Video

We had a great seminar by Rob Meyer, Global Kinetics Executive Team, on August 27th! Rob Meyer is well known within the European software distribution industry and Top 500 European Enterprises. Rob was involved with the first Apple shipments in Europe and the initial...

Global Kinetics Seminar

Considering expansion in the European Union?

Where do you land your business in Europe? If you consider to kick off your business in the European Union, be aware that circumstances differ considerably. The chart above (OECD tax rates 2018) shows the variety for corporate income tax per country in Europe. Recent...

The UK is Sleepwalking Towards Disaster

BORIS JOHNSON AND YOUR BUSINESS….

GK Attending Hannover Messe 2018

Global Kinetics is pleased to announce our participation at Hannover Messe 23 – 27 April 2018. Hannover Messe Info Our booth will be located in the U.S. Investment Pavilion. Online Map Rob Meyer, Executive Director & VP EMEA, will be offering FREE Brexit Stress Test for US Companies. USA based companies with UK based European subsidiaries are cordially invited […]

FREE Brexit Stress Test for US Companies

Short term Impact of Brexit for US businesses in Europe Hannover Messe: April 24-28/2017 U.S. Investment Pavilion Hall 3. Stand F04/8 Posted by Rob Meijer on March 21st, 2017 There were in recent European history, that ambition was lead by business competence and...

GK Attending Hannover Messe 2017

Global Kinetics is pleased to announce our participation at Hannover Messe 24 – 28 April 2017. Hannover Messe Online Info Our booth is located in the U.S. Investment Pavilion, Hall 3, Stand F04/8. Online Map Rob Meyer, Executive Director & VP EMEA, will be offering FREE Brexit Stress Test for US Companies. USA based companies with UK based European […]

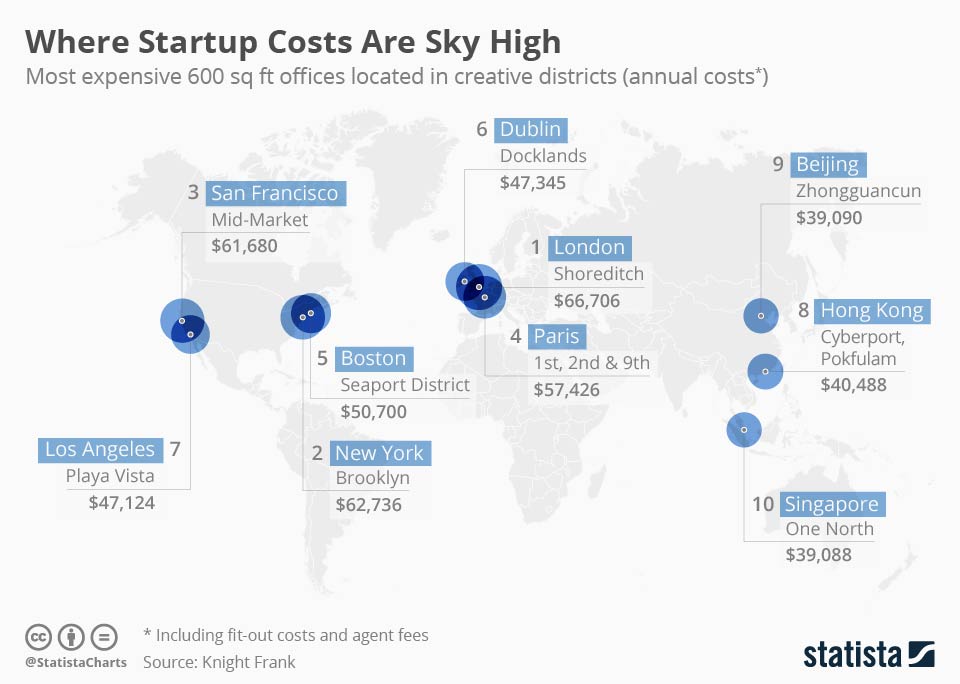

Avoiding Sky High Startup Costs

Office space can prove detrimentally expensive for startups seeking to establish themselves in major cities worldwide. London's Shoreditch district has been named the costliest creative district worldwide in a report by Knight Frank. Leasing and fitting-out a 600 sq...

Take Your Company Global

Global Kinetics is an international accelerator enabling US companies to quickly penetrate European markets, scale operations, and compete in the EU as a European entity to increase sales, access new markets, build market share, and brand awareness; all while increasing shareholder value.