Where do you land your business in Europe?

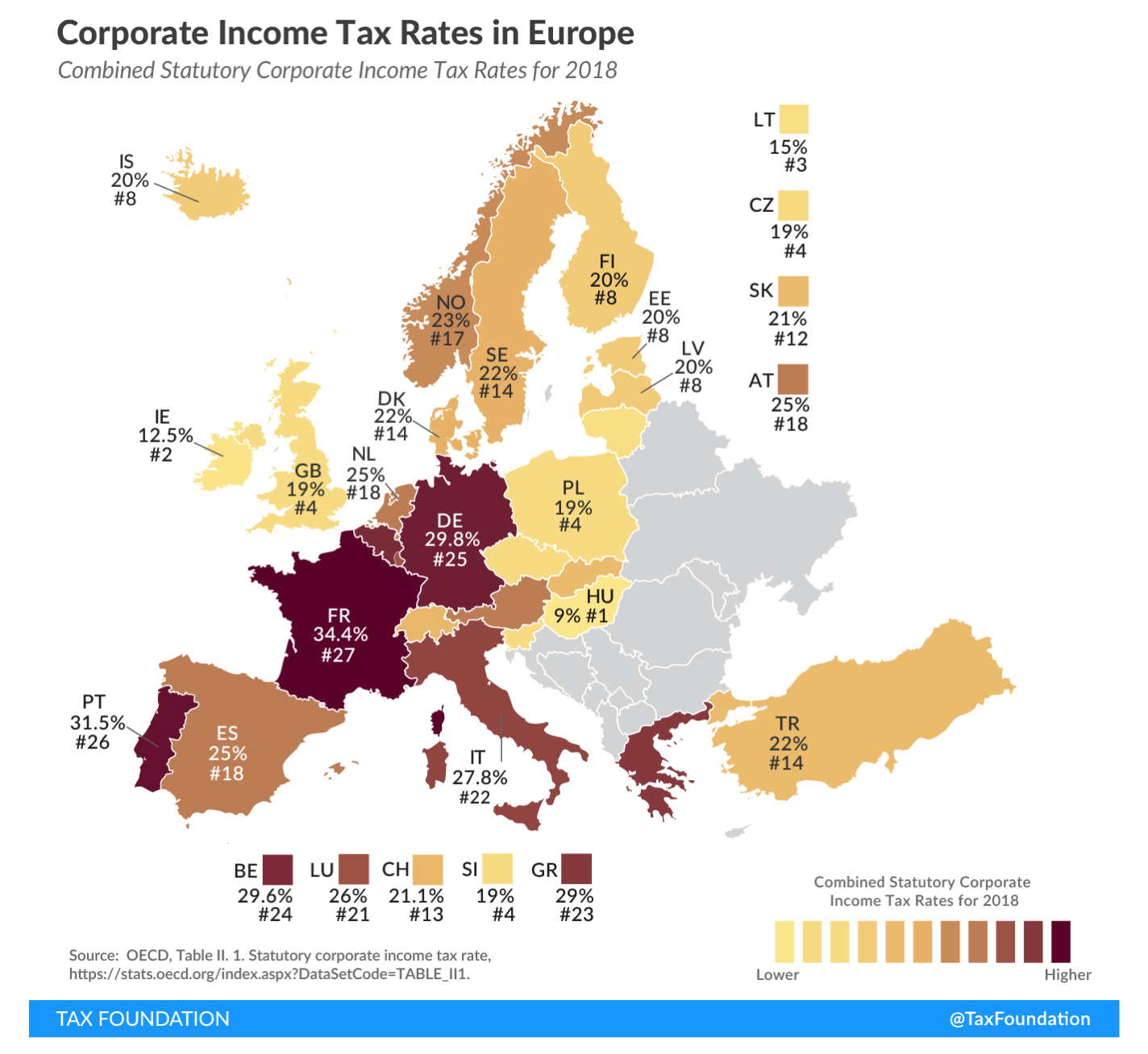

If you consider to kick off your business in the European Union, be aware that circumstances differ considerably. The chart above (OECD tax rates 2018) shows the variety for corporate income tax per country in Europe.

Recent developments in the Netherlands (20.5, 16.5 and 15%)

Public and private companies in the Netherlands are subject to Dutch corporate tax on their profits. If the taxable amount is less than €200,000, a Dutch corporate tax rate of 19% applies; if the taxable amount is €200,000 or higher, companies are liable to pay a Dutch corporate tax rate of 25%.

The standard rate will be reduced to 22.55% in 2020 and 20.5% in 2021. However, the lower rate will decrease to 16.5% in 2020 and to 15% in 2021.

The map above shows statutory CIT rates in 27 European countries. These CIT rates include the federal, state, and local taxes where there are multiple levels of government. The country with the highest CIT rate is France (34.4 percent), followed by Portugal (31.5 percent) and Germany (29.8 percent). Germany’s rate includes the 15 percent federal rate and municipal trade taxes, making the combined rate nearly twice the federal rate at 29.8 percent. The countries with the lowest CIT rates are Hungary (9.0 percent), Ireland (12.5 percent), and Lithuania (15.0 percent). The majority of European countries tax corporate income at rates that range between 19 and 25 percent.

Source; Tax Foundation https://taxfoundation.org/corporate-tax-rates-europe-2019/

©Rob Meijer/Global-Kinetics/Global301